| Page Properties | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||

|

| Info | ||

|---|---|---|

| ||

|

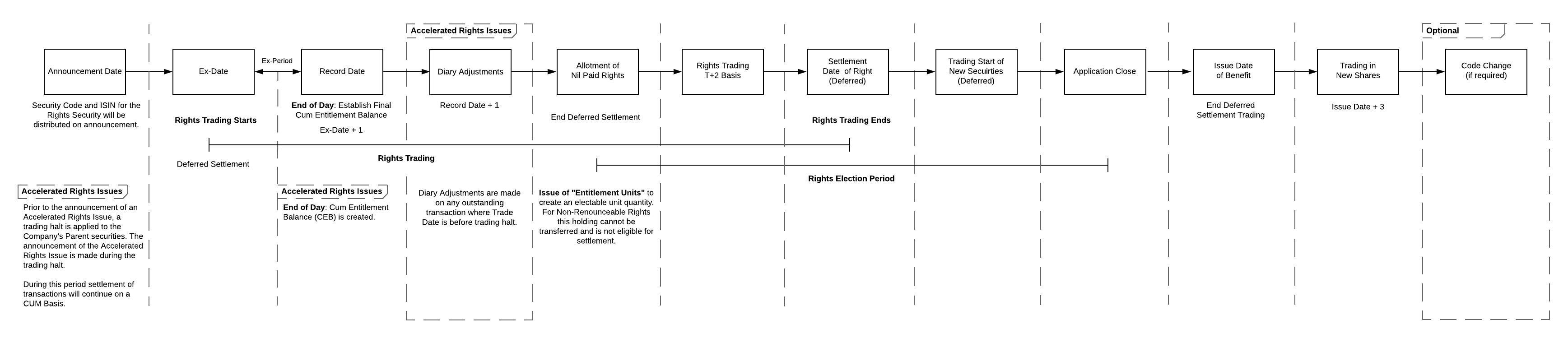

Rights Issue Timeline

The following timeline provides an overview of the key events for a Rights Issue and approximate times after announcement that these events occur. Accelerated Rights Issues both renounceable and non-renounceable, allow for the acceleration of the Institutional component of the Rights Issue. A more detailed process flow and associated requirements are provided in subsequent sections.

Rights Issue Process

The following steps describe the above process flow.

Announcement of Event

Announcement Date of the event to the market.

Announcement of Accelerated Rights

A trading halt in the Parent Securities is requested by the Issuer before the commencement of trading on the day the Parent securities are placed into a trading halt. Settlement of transactions is not suspended and continues during this period on a Cum Basis of Movement only.

The announcement of the Accelerated Rights Issue is made during the trading halt, but before trading resumes.

| Info |

|---|

Accelerated Rights Issues are processed as per any other Rights Issue, typically securities are issued in two tranches; the institutional offer and the retail offer. |

Ex-Date (not applicable to Accelerated Rights Issues)

At the start of the day on the Ex-Date for a Rights Issue (Renounceable or Non-Renounceable), the CSP establishes a notional Cum Entitlement Balance for each holding in the parent security on the CSP sub-register. The Issuer (Registry) establishes similar positions for holdings on the Issuer Sponsored sub-register.

| Info |

|---|

Non-Renounceable Rights are non-transferable and therefore must be either taken-up (in full or part) or lapsed. Following confirmation from the Association of National Numbering Agencies (ANNA) in September 2019, an International Securities Identification Number (ISIN) will be attributed to Non-Renounceable Rights Issues. This will enable the creation of an electable unit (Application Elections). |

Ex-Period

During the Ex-Period, the CSP maintains both the holding balance and the separate Cum Entitlement Balance for each holding of the parent security. This facilitates the designation of transactions during the period between the Ex Date and the Record Date as being either Cum or Ex the entitlement.

Basis of Movement overrides are not applicable to Accelerated Rights Issue Corporate Action events as trading in the Parent Security is suspended before the corporate action is announced and trading resumes on an Ex entitlement basis on or around the Record Date. Consequently there are no settlements on an Ex Basis of Movement prior to the Record Date.

For further information, refer to /wiki/spaces/CSP/pages/66946583.

Record Date

On or shortly after the record date, the CSP reports the Cum Entitlement Balances of holdings in the Parent Security on the CSP sub-register in response to a request from the Issuer (Registry).

After the close of business on Record Date, the CSP adjusts all outstanding Cum Settlement Transactions. Accrual obligations are generated for the new securities. The CSP notifies participants of the adjusted and accrued transactions.

For an Accelerated Rights Issue, Cum Entitlement Balance (CEB) are created at the end of day on the Record Date.

For further information, refer to /wiki/spaces/CSP/pages/66946583.

Diary Adjustments

The CSP will perform automatic diary adjustments to outstanding “cum” obligations to create accruals in the entitled securities. For accelerated offers, all transactions are deemed “cum”. For further information, refer to /wiki/spaces/CSP/pages/245730632.

Allotment of Nil Paid Rights

The Issuer (Registry) will initiate a Holding Balance Adjustment on an Issue Date (All Rights), including a reason for the Holding Balance Adjustment. For further information on Holding Adjustment Reasons, refer to the /wiki/spaces/CSP/pages/23233122 (HoldingAdjustmentReason). For further information, refer to /wiki/spaces/CSP/pages/112427568.

Right Trading Period (Renounceable Rights)

Rights Trading commences on a deferred settlement basis on the Ex-Date. Deferred settlement trading of the Rights concludes on the business day immediately after the dispatch of Offer documents with trading on a normal basis (T+2) settlement commencing on the next business day. Rights trading concludes 5 business days before the applications closing date.

Application Close Date

On Applications Close Date at End of Day, Diary Adjustments will be performed on any outstanding transactions to adjust the value for application monies due. For further information, refer to /wiki/spaces/CSP/pages/245730632.

This is also the deadline for the Entitlement Election Process. For further information, refer to /wiki/spaces/CSP/pages/245466848.

Issue Date (Benefit)

The Issuer (Registry) will initiate a Holding Balance Adjustment on an Issue Date (Benefit), including a reason for the Holding Balance Adjustment. For further information on Holding Adjustment Reasons, refer to the /wiki/spaces/CSP/pages/23233122 (HoldingAdjustmentReason). For further information, refer to /wiki/spaces/CSP/pages/112427568.

Trading in New Shares

At the conclusion of Rights Trading, New Shares commence trading on a deferred settlement basis until the Issue Date. On the First Settlement Date (business day immediately following the Issue Date) of the New Shares, transactions will settle in the Batch Settlement process. For further information, refer to /wiki/spaces/CSP/pages/86836695.

Code Change Diary Adjustment (if required)

A Code Change Diary Adjustment (CCDA) may be applied. For further information, refer to /wiki/spaces/CSP/pages/245730632| Note |

|---|

Corporate action lifecycles have been integrated into the APG and are now available in: |

| Insert excerpt | ||||||

|---|---|---|---|---|---|---|

|

| Insert excerpt | ||||||

|---|---|---|---|---|---|---|

|

| Insert excerpt | ||||||

|---|---|---|---|---|---|---|

|