CDE 10 - Non-Novated Settlement Obligations Process

Table of Contents

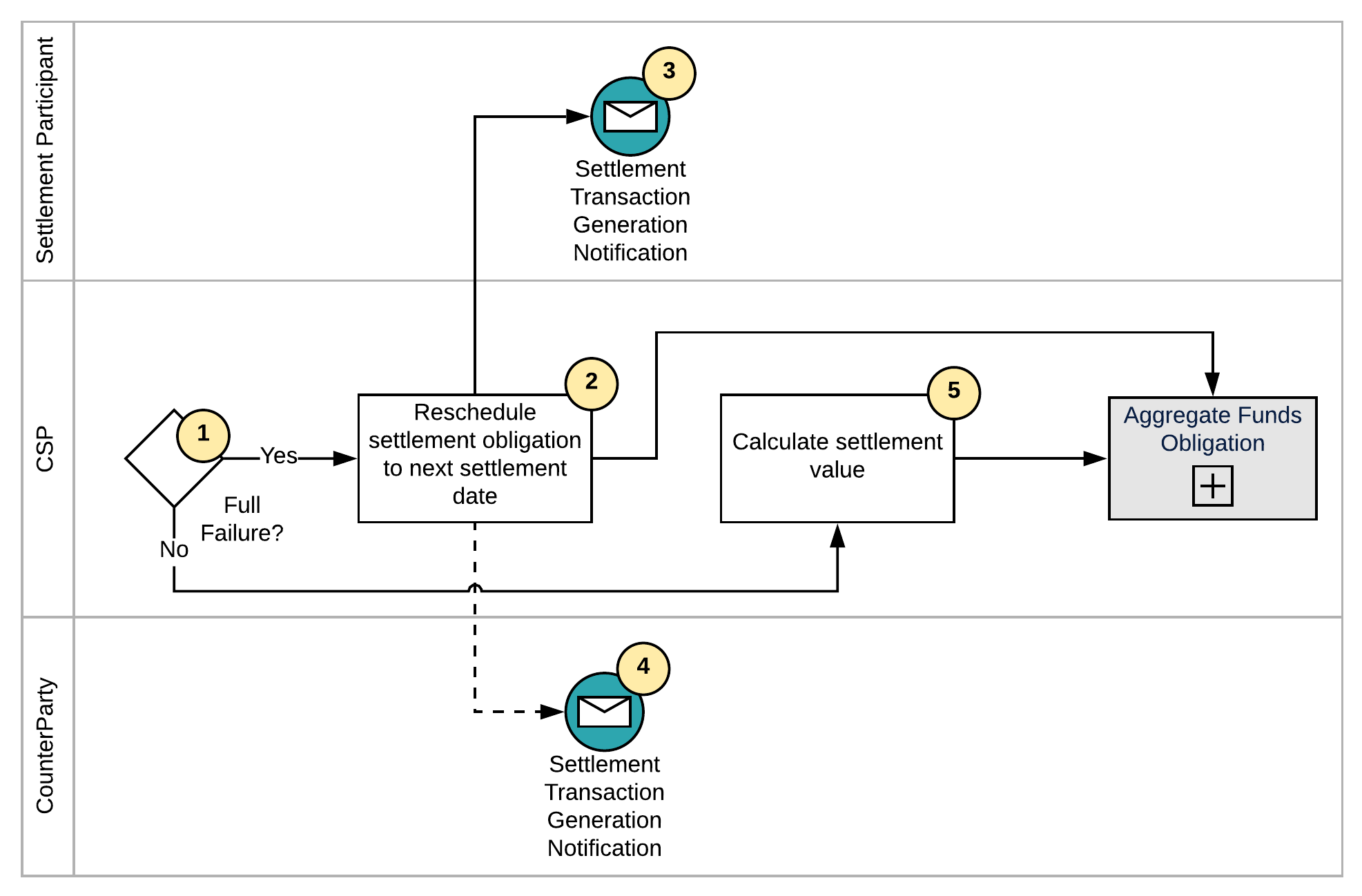

Non-Novated Settlement Obligations Process Flow

Non-Novated Settlement Obligations Process

| Step | Description | Party | Recipient | Message Reference |

|---|---|---|---|---|

| 1 | The CSP determines whether there is a Full or Partial Failure. If there is a Full Failure, refer to Step 2; "Full Failure". If there is a Partial Failure, refer to Step 5, "Partial Failure". | CSP | - | - |

| Full Failure | ||||

| 2 | The CSP reschedules settlement obligation to the next settlement date. | CSP | - | - |

| 3 | The CSP sends a Settlement Transaction Generation Notification (sett_130) to the Settlement Participant. | CSP | Settlement Participant | Settlement Transaction Generation Notification (sett_130) |

| 4 | Where the Settlement Instruction is a Bilateral Scheduled Settlement Instruction (BSSI) or a Non-Novated Gross Market Trade (NNGMT), the CSP sends a Settlement Transaction Generation Notification (sett_130) to the Counterparty. Where all Accounts (HINs) have sufficient units, the CSP will invoke the /wiki/spaces/CSP/pages/86675272. | CSP | Counterparty | Settlement Transaction Generation Notification (sett_130) |

| Partial Failure | ||||

| 5 | The CSP calculates the Settlement Value of the failed quantity. Where all Accounts (HINs) have sufficient units, the CSP will invoke the /wiki/spaces/CSP/pages/86675272. | CSP | - | - |

Business Values and Rules

Settlement Transaction Generation Notification

A Settlement Transaction Generation Notification (sett_130) is sent to the Settlement Participant, advising that their Settlement Instruction has been rescheduled to a new settlement date as a result of a unit shortfall.

ASX Element Name | ISO 20022 Element | Guidelines |

|---|---|---|

| Target Transaction Id | Transaction Identification Details / Account Owner Transaction Identification | The identifier of the Settlement Instruction that has been rescheduled. For Unilateral Scheduled Settlement Instructions (USSIs) and BSSIs, this will be the Transaction Id that was sent in the Settlement Instruction Request (sett_105). For a Non-Novated Gross Market Trade (GMTD), this will be populated with NONREF. |

| Transaction Id | Transaction Identification Details / Account Servicer Transaction Identification | Uniquely identifies a transaction in the CSP. For a USSI and BSSI, the Transaction Id will not be populated. For a GMTD, this will be the Transaction Id that was sent in the Trade Confirmation Notification (sett_101). |

| Obligation Id | Transaction Identification Details / Market Infrastructure Identification | Indicates the Obligation Id assigned by CSP when a settlement instruction is confirmed or scheduled. |

| Security Code | Financial Instrument Identification | Indicates the security related to the Settlement Instruction. Both Security Code and ISIN will always be present on the Settlement Transaction Generation Notification sent to the Settlement Participant. |

| Account Identifier (HIN) | Safekeeping Account | Identifier of an Account (HIN) within the CSP. For a USSI, the Account (HIN) is the Delivering Account Identifier (HIN). For a BSSI and GMTD the Account (HIN) will be:

|

| Remaining Units Awaiting Settlement | Settlement Quantity / Quantity / Unit | Indicates the number of units scheduled for settlement on the Settlement Date for the Settlement Instruction. |

| Securities Movement Type | Security Movement Type | Indicates the Securities Movement Type of the Settlement Instruction. The Securities Movement Type is Delivery (DELI), where the Settlement Participant is the Delivering Participant. The Securities Movement Type is Receive (RECE), where the Settlement Participant is the Receiving Participant. |

| Payment | Payment | Indicates the Payment type of the Settlement Instruction. Either "Against Payment" (APMT) or "Separate Settlement" (FREE) will be present. |

| Settlement Link Id | Linkages / Reference / Securities Settlement Transaction Identification | Where applicable, indicates the Settlement Link Id that is common for each linked transactions, allowing multiple Settlement Instructions to be linked together. |

| Settlement Transaction Condition | Settlement Parameters / Settlement Transaction Condition | The Settlement Transaction Condition defines the type of the Transaction. In this case either:

|

| Rescheduled Settlement Date | Trade Details / Settlement Date / Date / Date | Indicates the date the Settlement Instruction has been scheduled / rescheduled for settlement. Where the Settlement Transaction Condition is GMTD, USSI or BSSI, the Settlement Date is the next business date. |

| Current Settlement Date | Trade Details / Settlement Instruction Processing Additional Details | Indicates the business date the settlement instruction was scheduled to be settled. |

| Basis of Movement 1, 2 and 3 | Trade Transaction Condition / Code / Proprietary / Identification | Indicates, where applicable, the corporate action entitlement(s) scheduled to settle for the Settlement Instruction being notified. In this case, one of the valid values outlined in the /wiki/spaces/CSP/pages/23233122 (16 - BasisofMovement) will be present |

| Transaction Basis | Settlement Parameters / Securities Transaction Type | Indicates the type of securities transaction. In this case, one of the valid values outlined in the /wiki/spaces/CSP/pages/23233122 (9 - TransactionBasisCode) will be present. |

| Receiving Settlement Participant | Receiving Settlement Participant / Parties / Party 1 / Identification | Indicates the Settlement Participant which controls the Account (HIN) receiving units. |

| Remaining Cash Awaiting Settlement | Settlement Amount / Amount | Indicates the funds scheduled for settlement to the relevant settlement date for the Settlement Instruction. |

| Remaining Cash Awaiting Settlement Credit Debit Indicator | Settlement Amount / Credit Debit Indicator | Indicates whether the Remaining Cash Awaiting Settlement is to be paid or received, either:

|

| Delivering Settlement Participant | Delivering Settlement Participant | Indicates the Settlement Participant which controls the Account (HIN) delivering units. |

Receiving Account Identifier (HIN) | Receiving Settlement Parties / Party 1 / Safekeeping Account | Where the Settlement Transaction Condition is USSI, indicates the receiving Account (HIN). Where the Settlement Transaction Condition is BSSI or GMTD, the Receiving Account Identifier will not be populated. |

Reason | Settlement Status / Pending / Reason | Indicates the reason for receiving this message. In this case, Failed Settlement - Unit Shortfall (FSUS) will be present since the Settlement Instruction is a rescheduled Settlement Instruction due to a unit shortfall. |

Related Pages:

Browse Popular Pages: No labels match these criteria.

This document provides general information only. ASX Limited (ABN 98 008 624 691) and its related bodies corporate (“ASX”) makes no representation or warranty with respect to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from anyone acting or refraining to act in reliance on this information. © 2022 ASX Limited ABN 98 008 624 691

- style