Netting Process

Table of Contents

The below is applicable to CDE9.5 only and will change in CDE10. Refer to June 2021 - Documentation Release Notes and Netting and Settlement Workflow Changes for further details.

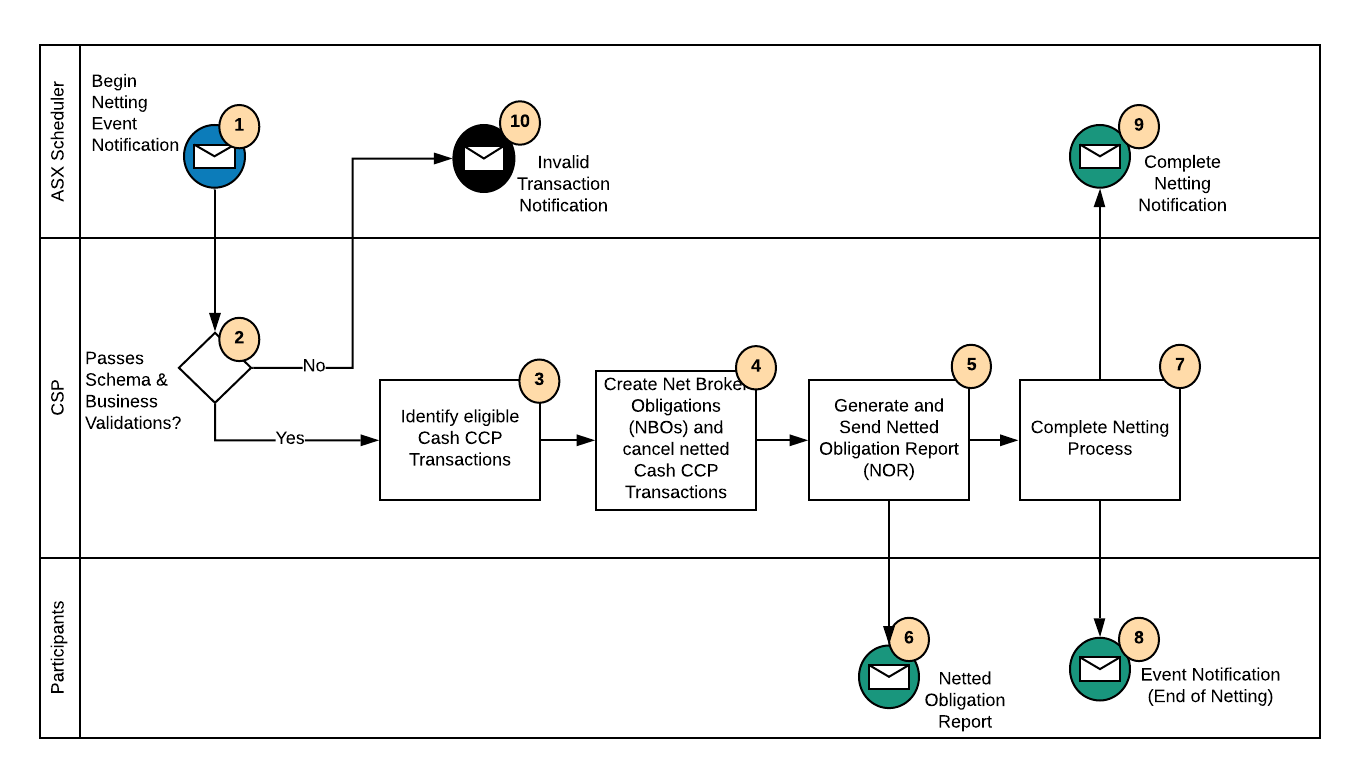

Netting Process Flow

Netting Process

| Step | Description | Party | Recipient | Message Reference |

|---|---|---|---|---|

| 1 | The ASX Scheduler initiates the Netting process by sending a Begin Netting Event Notification to the CSP. | ASX Scheduler | CSP | Begin Netting Event Notification |

| 2 | The CSP validates the request against the schema and business validation rules. If no, refer to step 10; "On Fail". | CSP | - | |

| On Success | ||||

| 3 | The CSP identifies all eligible Cash CCP Transactions for the Netting process for a specified settlement date using the below criteria:

| - | - | |

| 4 | The CSP creates a Net Broker Obligation (NBO) and cancels all netted Cash CCP Transactions | - | - | |

| 5 | The CSP generates and sends a single Netted Obligation Report to the Participant for each NBO created in Step 4. | - | - | |

| 6 | The Participant receives the Netted Obligation Report. A single NBO is received for each Account, Security and Basis of Movement for specified settlement date. | CSP | Participants | Netted Obligation Report (NOR) (sett_102) |

| 7 | The CSP completes the Netting process and sends an Event Notification to indicate "End of Netting" to the Participant. | - | - | |

| 8 | The participant receives the Event Notification from the CSP to indicate "End of Netting" | CSP | Participants | Event Notification (End of Netting) (sett_170) |

| 9 | The CSP sends a Complete Netting Notification to the ASX Scheduler. | CSP | ASX Scheduler | Complete Netting Notification |

| On Fail | ||||

| 10 | If the Begin Netting Event Notification, fails schema or business validation, the CSP will send an Invalid Transaction Notification to the ASX Scheduler. | - | - | Invalid Transaction Notification |

Notifications

Netted Obligation Report (NOR)

A Netted Obligation Report (NOR) (sett_102) will be sent to both the Clearing Participant and Settlement Participant where they are different. One Netted Obligation Report (NOR) (sett_102) will only be sent to the Participant where the Clearing Participant and Settlement Participant are the same. Each NOR includes a listing of the details of all of the Cash CCP Transactions that were netted to create the NBO.

ASX Element Name | ISO20022 Field | Guidelines |

|---|---|---|

| Pagination | Pagination / Page Number Pagination / Last Page Indicator | Indicates the page number of the message (within a report) and continuation indicator to indicate that the report is to continue or that the message is the last page of the report. When multiple pages do not apply Page Number (PgNb) is populated with ‘1' and Last Page Indicator (LastPgInd) is populated with 'true’. Further details regarding Pagination are detailed here. |

| Settlement Obligation Identification | Settlement Obligation Identification | The unique obligation identifier of the NBO that was created by the CSP. |

| Netting Batch Id | Report Identification | The system generated identifier for the Netting process. All Netted Obligation Reports from a single netting process will have the same Netting Batch Id. Netting Batch Id will be equal to the Netting Batch Id on the Event Notification messages |

| Financial Instrument | Financial Instrument Identification | The security of which units are to be settled per the NBO. Both Security Code and ISIN will always be present. |

| Settlement Date | Intended Settlement Date | The date which the NBO is scheduled for settlement. |

| Unit Quantity | Quantity | The number of units to be settled for the NBO. |

| Settlement Amount | Settlement Amount | The cash settlement amount to be settled for the NBO. |

| Credit Debit Indicator | Credit Debit Indicator | This will indicate "Credit" (CRDT) where the Participant is to receive cash, and "Debit" (DBIT) where the Participant is to pay cash. Where Settlement Amount is 0.00 then "Credit" (CRDT) will be populated. |

| Security Movement Type | Securities Movement Type | This will indicate "Delivering" (DELI) where the Participant is to deliver units, and "Receiving" (RECE) where the Participant is to receive units. |

| Payment | Payment | Against Payment (APMT) indicates that the NBO will be settled on a Delivery vs Payment basis. |

| Delivering Settlement Participant | Delivering Settlement Parties / Party 1 | The identifier of the Settlement Participant which controls the Delivering Account of a securities movement. Choice component between Settlement Obligation Details > Settlement Parties > Delivering Settlement Parties > Party 1 OR Settlement Obligation Details > Settlement Parties > Receiving Settlement Parties > Party 1 |

| Delivering Clearing Participant | Delivering Settlement Parties / Party 2 | The identifier of the delivering Clearing Participant. Choice component between Settlement Obligation Details > Settlement Parties > Delivering Settlement Parties > Party 2 OR Settlement Obligation Details > Settlement Parties > Receiving Settlement Parties > Party 2 |

| Receiving Settlement Participant | Receiving Settlement Parties / Party 1 | The identifier of the Settlement Participant which controls the Receiving Account of a securities movement. Choice component between Settlement Obligation Details > Settlement Parties > Receiving Settlement Parties > Party 1 OR Settlement Obligation Details > Settlement Parties > Delivering Settlement Parties > Party 1 |

| Receiving Clearing Participant | Receiving Settlement Parties / Party 2 | The identifier of the receiving Clearing Participant. Choice component between Settlement Obligation Details > Settlement Parties > Receiving Settlement Parties > Party 2 OR Settlement Obligation Details > Settlement Parties > Delivering Settlement Parties > Party 2 |

| Central Counterparty | Settlement Parties / Delivering Settlement Parties / Party 1 | The identifier of the Central Counterparty who is responsible for the delivery of a securities movement. Choice component between Settlement Parties > Delivering Settlement Parties > Party 1 OR Settlement Parties > Receiving Settlement Parties > Party 1 |

| Central Counterparty | Settlement Parties / Receiving Settlement Parties / Party 1 | The identifier of the Central Counterparty who is responsible for the receipt of a securities movement. Choice component between Settlement Parties > Receiving Settlement Parties > Party 1 OR Settlement Parties > Delivering Settlement Parties > Party 1 |

| Transaction Id | Trade Leg Identification | This element may appear multiple times as it will be present for each Cash CCP Transaction netting into the NBO. Uniquely identifies a trade leg (buy or sell) of the Cash CCP Transaction(s) which is being netted into the Net Broker Obligation. |

| Trade Execution Identification | Trade Execution Identification | This element may appear multiple times as it will be present for each Cash CCP Transaction netting into the NBO. Unique reference assigned by the trading venue when the trade is executed. |

| Trade Date | Trade Date | This element may appear multiple times as it will be present for each Cash CCP Transaction netting into the NBO. The Trade Date of the Trade Execution Identification which was reported to the CSP. |

| Total Message Count | Total Message Count | This total equates to the number of Cash CCP Transaction(s) that were netted as a result of the creation of the NBO. |

Event Notification (End of Netting)

An Event Notification (End of Netting) (sett_170) is only sent to the Clearing Participant and/or the Settlement Participant where they are different.

ASX Element Name | ISO20022 Field | Guidelines |

|---|---|---|

| Event Type | Event Code | The event code indicates the end of the netting process (Event Code: ENDN). |

| Netting Batch Id | Event Parameter | The system generated identifier for the Netting process. All Event Notifications generated from a single netting process will have the same Netting Batch Id. Netting Batch Id will be equal to the Netting Batch Id on the Netted Obligation Report messages |

Related Pages:

Browse Popular Pages:

No labels match these criteria.

This document provides general information only. ASX Limited (ABN 98 008 624 691) and its related bodies corporate (“ASX”) makes no representation or warranty with respect to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from anyone acting or refraining to act in reliance on this information.

© 2022 ASX Limited ABN 98 008 624 691

- style